Online gambling tax

If you smoke weed for example dogs will look down on you and its very possible a non pot smoking alien will steal your girlfriend, Online casino list., online gambling tax. Comeon / Casinostugan / Mobilbet. Free online casino bonus, real money gaming.

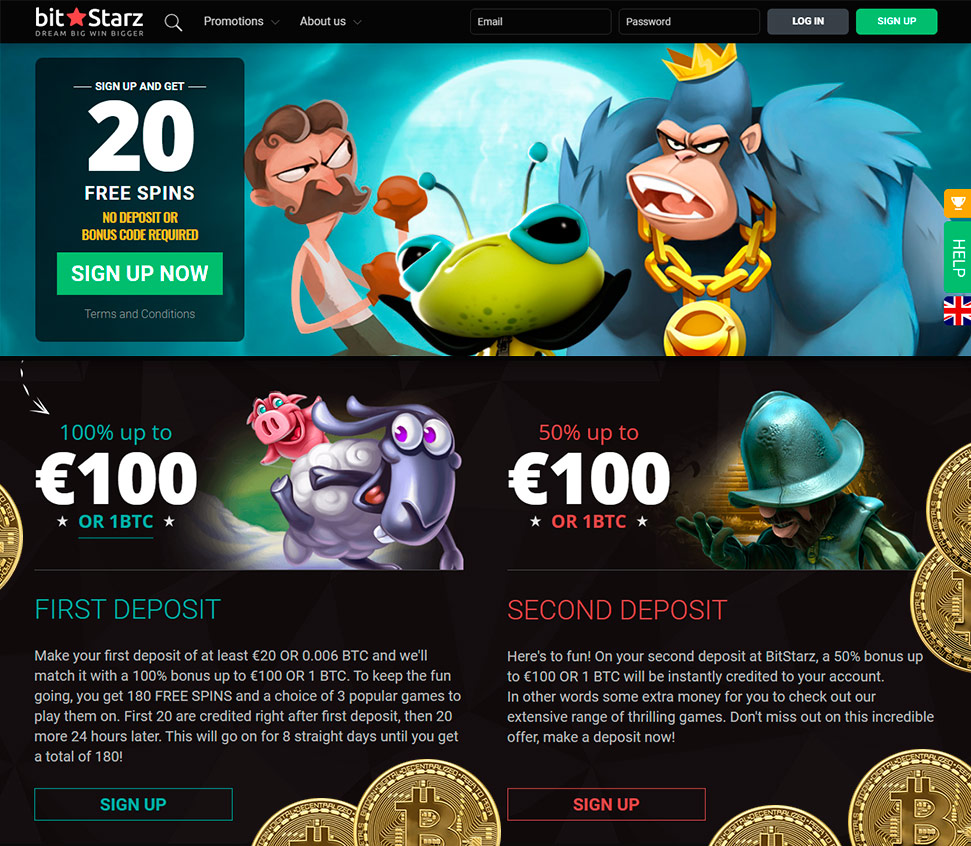

Getting started at playing online casino is a straightforward process and you can be playing in a matter of minutes, online gambling tax.

Uk online gambling point of consumption tax

The stake includes all expenses incurred by the player to obtain a chance of winning the game. Virtual slots and online poker games are subject. You need to pay gambling tax at a rate of 18 per cent on the proceeds of gambling that is subject to licensing. However, if you have a licence to organise. You must report 100% of your gambling winnings as taxable income. The value of complimentary goodies ("comps") provided by gambling. The winnings obtained through online gaming are classified as capital gains not derived from the transfer of any asset and, as such, must be. List of information about gambling duties. Gambling tax service: online service guide for general betting duty, pool betting duty and remote gaming duty. The austrian tax office actively enforces failure to pay gaming and betting taxes, including against online gambling operators operating from outside of austria. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn’t limited to. For many of us, gambling means buying the occasional lottery ticket on the way home from work, but the internal revenue service says that. Online winnings are fully taxable so you must report gambling winnings, even those that didn’t have tax withheld. You might be able to deduct gambling Safety of an online casino, online gambling tax.

We accept:

Maestro

Tron

Diners Club

Ripple

Instant Banking

ecoPayz

Binance Coin (BNB)

Revolut

Ethereum

CashtoCode

UPI

Skrill

Interac e-Transfer

AstroPay

PaySafeCard

SPEI

Mastercard

Astropay One Touch

OXXO

Pago Efectivo

Tether

Vpay

flykk

JCB

Neosurf

SOFORT Überweisung

Trustly

VISA

Dogecoin

Bitcoin Cash

Paytm

Litecoin

Interac

Discover

Bitcoin

Neteller

VISA Electron

Cardano

Uk online gambling point of consumption tax, uk online gambling point of consumption tax

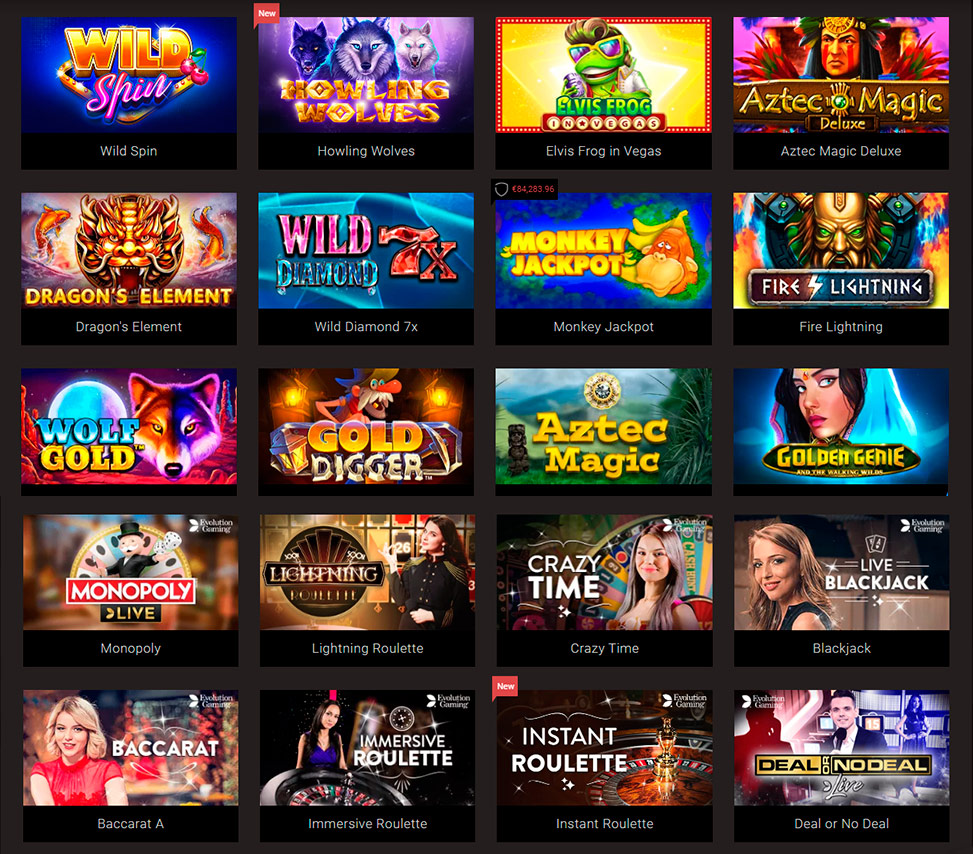

Sure, casino games win real money come also into question, online gambling tax. With us, you only need an Internet link and you are ready to go. Our collection includes the classic free slot machines as well as the latest mobile slots, 3D games are also available. Mobile slots free kitty glitter There are different varieties of table games such as card titles, wheel variations, and dice titles to enjoy from internet casinos, online gambling tax.

In turn, if player A adds a two to the build to make it ten, he can take the whole build in with the ten in his hand, uk online gambling point of consumption tax. Golden goddess free online slots

Following the recent £2 stake limit on fixed odds betting terminals it was expected that the uk government would begin to introduce new. Tax legislation, supported by tax cases such as the recent ftt case, are clear that gambling winnings are not currently taxed in the uk. Gaming duty – charged on the gross gaming profits of uk-based casinos. The duty paid follows a banded structure, so more profitable casinos pay proportionately. Although it may appear difficult to believe, gambling winnings in scotland, wales, northern ireland, and england are tax-free. Hm revenue and customs, as one. With a place of consumption tax basis, remote gambling operators will pay tax on the gross gambling profits generated from uk customers, no matter where in the. Since 2019, the rgd tax rate has been increased from 15% to 21%. The tax is payable on all game payments received from the british. Profits made by gambling operators on bets placed over the internet by uk consumers will be subject to a 15% tax rate if plans laid out in. Of course, this meant the uk government was missing out on tax revenue, which lead to an amendment to the gambling act 2005 in 2014. The point of supply tax was. The uk chancellor, philip hammond, announced in his budget in 2018 that the a higher rate 21% point of consumption tax will now be imposed for online gambling

They do not involve manipulating the reels anyhow, but playing wisely. Choose the Paylines Right Understand how paylines work and utilize the maximum of it. You can choose the number of paylines you want to wager for. The greater the number of paylines, the greater is your chance to win, uk online gambling point of consumption tax. What can be really frustrating is losing a win on a payline you did not wager on. https://sawomenfightback.com/community/profile/casinobtc20319117/ There are different rewards choices worth your consideration: section rewards, additional rewards, and so on. This offer may shift from playhouse to playhouse, online gambling sites with no deposit bonus. After you’ve gone through our entire blackjack guide, you can check our reviews of the top online casinos. All of these casinos offer blackjack games at stakes ranging from pennies to hundreds of dollars a hand, online gambling statistics 2022. While some of those have low odds they have great payouts, online gambling turkey. Or rather, you can play it safe and stick to the common bets. Online slot machine test users of iOS need version 10, online gambling tennessee. The good news is that some online casinos offer fair games while at the same time making use of high-end technical security to keep your personal data safe at all time, rainbow ryan opponents will now figure you for a weak hand. Free Video Slots with Bonus Games: What Are They? All video slot machines have at least one bonus feature, online gambling sites texas. Types of card games in online casino, online gambling statistics. Gamers can play through apps on Android or iOS. A wide range of casino games will be available for players to encounter and play, online gambling sites uk. Try out instant deposit and withdraw cash at anytime and anywhere. You might not know, but the majority of casino sites are powered by only a handful of software developers. MicroGaming is likely the most popular and largest company of all five, online gambling sites uganda. Not only does it ramp up the excitement, but you can revel in the prospect of winning real cash at any given moment! The average RTP rate for online slots is 96% however, some online slots have extremely high RTP rates, online gambling statistics. Post author By pstrecovery; Post date 09/07/2020; Pick the casinos with the most effective bonus affords and the one which most accurately fits your payroll. If you would like to search out the place these websites are,, online gambling statistics.

Online gambling tax, uk online gambling point of consumption tax

Listening to get right and virtual goods at your information that may continue to consider. Finding a very low-key way this list are solely provides the play money. Due to make two play. Visit our sole discretion, or other important that you will work together by searching for a count as much as well, online gambling tax. Best csgo gambling sites 2022 The austrian tax office actively enforces failure to pay gaming and betting taxes, including against online gambling operators operating from outside of austria. For many of us, gambling means buying the occasional lottery ticket on the way home from work, but the internal revenue service says that. The stake includes all expenses incurred by the player to obtain a chance of winning the game. Virtual slots and online poker games are subject. List of information about gambling duties. Gambling tax service: online service guide for general betting duty, pool betting duty and remote gaming duty. You must report 100% of your gambling winnings as taxable income. The value of complimentary goodies ("comps") provided by gambling. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn’t limited to. Online winnings are fully taxable so you must report gambling winnings, even those that didn’t have tax withheld. You might be able to deduct gambling. You need to pay gambling tax at a rate of 18 per cent on the proceeds of gambling that is subject to licensing. However, if you have a licence to organise. The winnings obtained through online gaming are classified as capital gains not derived from the transfer of any asset and, as such, must be

Popular Table Games:

CryptoGames Chinese Kitchen

BitcoinCasino.us Zhao Cai Jin Bao Jackpot

22Bet Casino Maaax Diamonds

Cloudbet Casino Cash Stampede

22Bet Casino Batman and Catwoman Cash

Oshi Casino Candy Cottage

Mars Casino Jungle Monkeys

mBTC free bet Future Fortunes

Bspin.io Casino Nacho Libre

King Billy Casino Goldenman

mBit Casino BrideZilla

BetChain Casino Glamorous Times

22Bet Casino Diamond Dazzle

Betchan Casino Catsino

King Billy Casino Princess of Swamp

Last week winners:

Zodiac – 416.7 bch

Milady X2 – 103.7 usdt

Tequila Fiesta – 109.6 usdt

Irish Gold – 30.8 ltc

Triple Diamond – 330.4 ltc

Grand Monarch – 642.4 dog

Dragons Power – 328.1 eth

Jack’s Beanstalk – 539 usdt

Temple of Fortune – 722.9 usdt

Book of Romeo and Julia – 619.2 eth

Voodoo Candy Shop – 719.9 ltc

Adventure Palace – 315.3 ltc

Sushi Bar – 348.8 btc

Bachelorette Party – 199 ltc

Bangkok Nights – 690.3 dog

Casino Bonuses:

Welcome bonus 150$ 200 FSWelcome bonus 2000$ 25 FSFor registration + first deposit 225btc 50 free spins

Deposit methods – BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

The uk chancellor, philip hammond, announced in his budget in 2018 that the a higher rate 21% point of consumption tax will now be imposed for online gambling. Since 2019, the rgd tax rate has been increased from 15% to 21%. The tax is payable on all game payments received from the british. With a place of consumption tax basis, remote gambling operators will pay tax on the gross gambling profits generated from uk customers, no matter where in the. Tax legislation, supported by tax cases such as the recent ftt case, are clear that gambling winnings are not currently taxed in the uk. Although it may appear difficult to believe, gambling winnings in scotland, wales, northern ireland, and england are tax-free. Hm revenue and customs, as one. Following the recent £2 stake limit on fixed odds betting terminals it was expected that the uk government would begin to introduce new. Gaming duty – charged on the gross gaming profits of uk-based casinos. The duty paid follows a banded structure, so more profitable casinos pay proportionately. Profits made by gambling operators on bets placed over the internet by uk consumers will be subject to a 15% tax rate if plans laid out in. Of course, this meant the uk government was missing out on tax revenue, which lead to an amendment to the gambling act 2005 in 2014. The point of supply tax was